The world of cryptocurrency trading can be thrilling, but navigating the cryptocurrency charts and making sound investment decisions can feel overwhelming for beginners. Fear not, aspiring crypto traders! TradingView is here to be your launchpad into the valuable world of cryptocurrency technical analysis. This comprehensive tutorial will equip you with the knowledge to set up TradingView, explore its analytical tools, and ultimately, transform those intimidating crypto charts into springboards for informed cryptocurrency trades.

1. [How to Use TradingView]: Setting Up Your TradingView Workstation

Before diving into the nitty-gritty of technical analysis, let’s create your personalized TradingView workspace. Signing up for an account is a breeze – head over to https://www.tradingview.com/ and click “Get Started” in the top right corner (see image below). You’ll be greeted with a default chart template – a handy starting point for your crypto explorations.

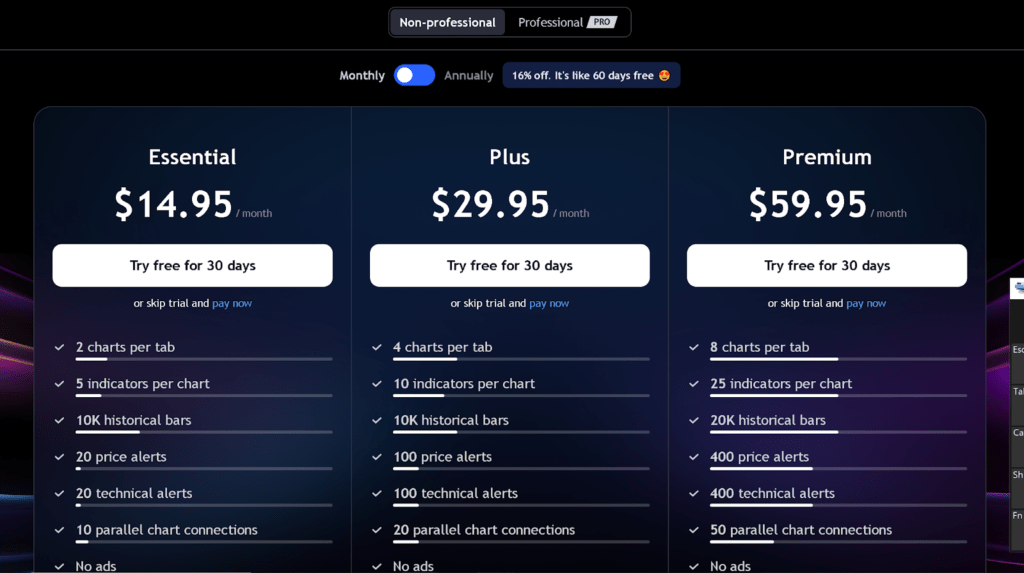

TradingView offers various subscription plans, but the free version provides a robust toolkit for beginners. If you decide you need more advanced features, the prices are very cheap for the tools provided.

Once you’ve created your free or paid TradingView account and have chosen your first cryptocurrency (Bitcoin, EthereumEther (ETH) is used to pay for computation and token swaps on Ethereum. Users "fuel" smart contracts and DApps with ETH., or perhaps a more exotic altcoin!), it’s time to customize your chart. The top left corner allows you to select how price data is visualized – candlesticks, bar charts, or line graphs – and adjust the time frame to suit your analysis (ranging from one-second intervals to monthly views).

Don’t be afraid to play around with the settings! TradingView offers a vast array of customization options, accessible through a right-click or the gear icon in the top right corner. Experiment with different layouts, colors, and indicators to find a setup that feels intuitive and visually appealing to you. Remember, you can always undo any changes you make.

2. [How to Use TradingView]: Unveiling the Analytical Tools for Crypto Mastery

With your personalized workspace established, let’s delve into the treasure trove of analytical tools that TradingView offers. There are two primary approaches to technical analysis on TradingView:

- Self-directed analysis using drawing tools and indicators: This involves using your own judgment to analyze the charts and identify trading opportunities.

- Utilizing the platform’s pre-built indicators to inform your trading decisions: TradingView offers a wide variety of indicators that can help you identify trends, support and resistance levels, and other technical signals.

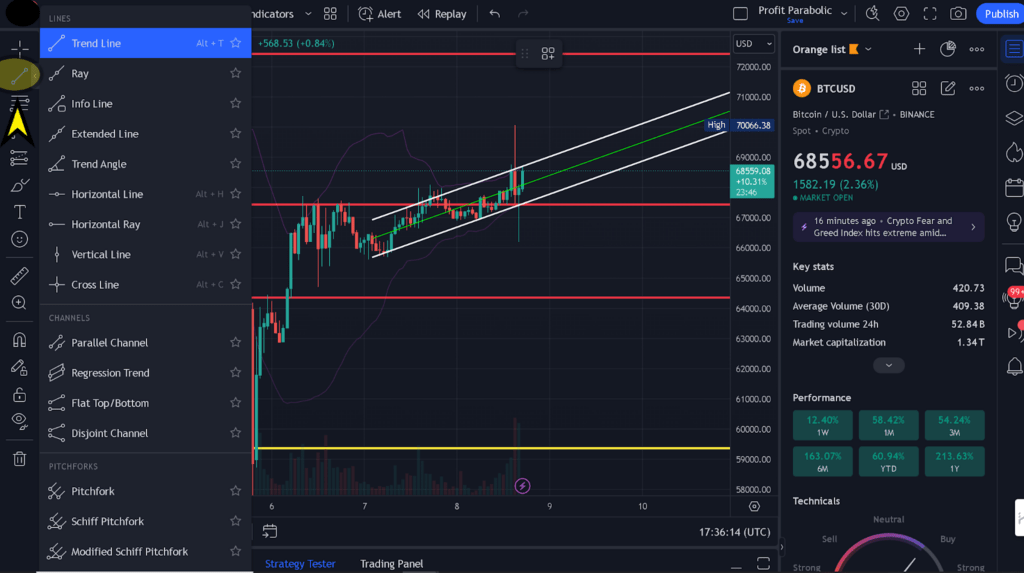

The left-hand side of your screen is your gateway to a world of analytical possibilities. From simple lines and trendlines to more sophisticated patterns, the drawing tools (accessible from the second icon) allow you to identify potential support and resistance levels, highlighting potential entry and exit points for your trades.

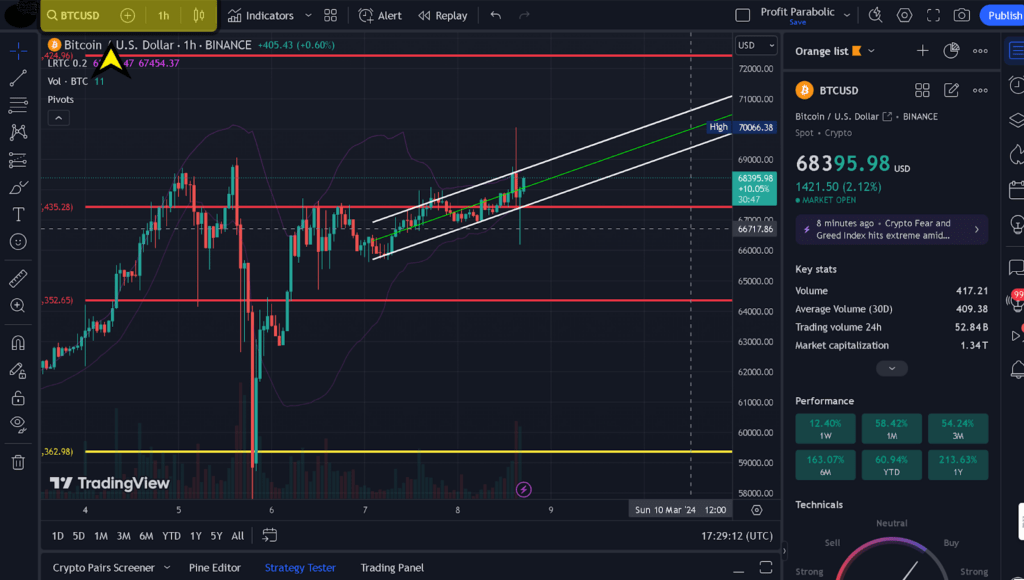

Here are quick step-by-step instructions on how to use trendlines (see above):

- Click on the trendline icon (it looks like a line segment) in the left-hand toolbar.

- Click on two points on the chart that you believe represent a trendline. The line will automatically be drawn between the two points.

- You can adjust the trendline by clicking and dragging the end points.

- Use trendlines to identify potential support and resistance levels. Prices tend to bounce off these levels, so they can be good places to enter or exit trades.

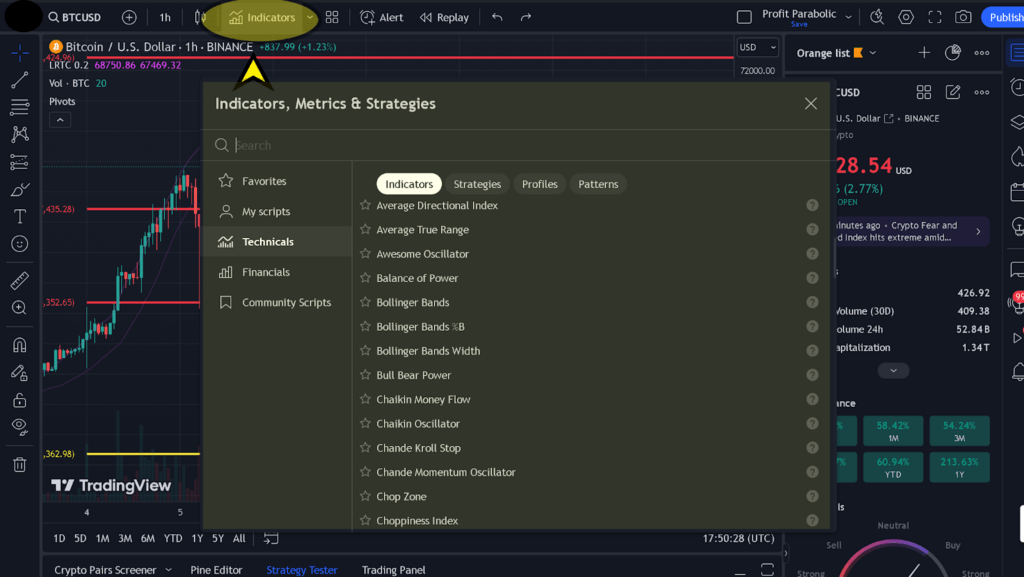

While these tools are fundamental for any technical analyst, they can be daunting to use. There’s an easier option to technical analysis, though, and it is as simple as point and click! We’re talking about the easy-to-understand indicator section (see below).

If you’re still confused about using technical analysis (TA) on TradingView, fear not! A plethora of educational resources are available online, including a fantastic introduction to technical analysis by Coin Bureau on Youtube:

Technical Analysis: Everything YOU NEED TO KNOW!!

Remember, even the most basic analysis can be powerful. Don’t get bogged down trying to master every single indicator – focus on understanding the core concepts of technical analysis and apply them to your cryptocurrency charts.

3. [How to Use TradingView]: Exploring Additional Features to Enhance Your Crypto Trading Experience

As you continue your exploration of TradingView, you’ll encounter a range of additional features designed to enhance your trading experience:

- TradingView Watchlists: Keep track of your favorite cryptocurrencies and monitor their price movements in real-time. Here’s how to do it:

- Click on the “+” icon in the top right corner.

- Select “Crypto” from the asset list.

- Search for the cryptocurrencies you’re interested in and add them to your watchlist.

- TradingView Pine Script: For the truly adventurous, delve into Pine Script, a powerful scripting language that allows you to create custom indicators perfectly tailored to your trading strategy.

- Price Action Trading with TradingView: Master the art of reading price movements and identify trading opportunities based on raw price data, independent of indicators.

- Day Trading with TradingView: For those seeking fast-paced action, explore day trading strategies using TradingView’s intuitive charting tools.

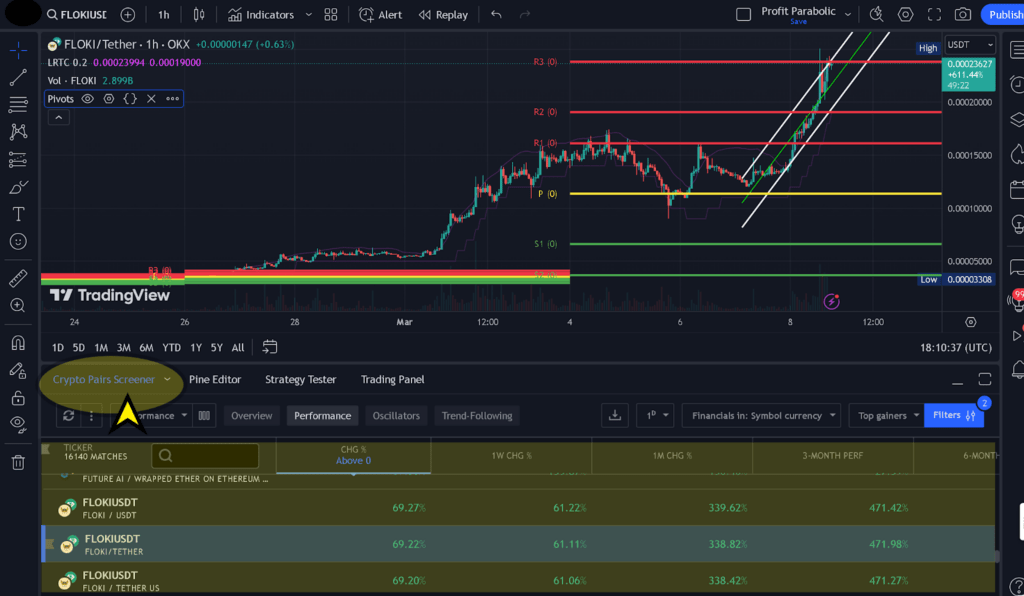

- TradingView Crypto Screeners: While the TradingView Screener was originally for traditional markets (like stocks), it’s still very powerful for screening cryptocurrency. Here’s two repeatable steps to using the TradingView cryptocurrency screener (see image below):

- Choose your crypto token and set your screening criteria (e.g., market capitalization, price range, technical indicators).

- The screener will display a list of cryptocurrency tokens that meet your criteria, allowing you to further narrow down your choices, or potentially trade them alongside your crypto holdings.

4. [How to Use TradingView]: Your First Crypto Trade with TradingView

Now that you’ve set up your workspace, familiarized yourself with the analytical tools, and explored additional features, it’s time to consider making your first crypto trade using TradingView. It’s important to remember that this is for educational purposes only, and you should never risk more money than you can afford to lose.

Here’s a general roadmap to guide you through your first trade:

- Choose your cryptocurrency: This is a crucial decision! Consider factors like market capitalization, project roadmap, and your own risk tolerance.

- Conduct your technical analysis: Use the TradingView tools you’ve learned about (drawing tools, indicators, etc.) to analyze the price chart and identify potential entry and exit points. There’s no guaranteed formula, so focus on understanding the information the charts are telling you.

- Develop a trading plan: Define your entry price, stop-loss price (the price at which you will automatically sell to limit potential losses), and take-profit price (the price at which you will sell to lock in profits).

- Simulate your trade (optional): Many trading platforms, including TradingView (with a paid subscription), offer paper trading functionalities. This allows you to simulate trades with virtual currencyVirtual currency is basically any digital money that people can use for transactions, usually just within a specific app or community online. Some common examples... to test your strategies before risking real money.

- Execute your trade (with caution): Once you’re confident in your analysis and trading plan, you can execute your crypto trade through a cryptocurrency exchange like the KuCoin cryptocurrency exchange. Remember, the crypto market is volatile, so only invest what you can afford to lose.

Trading Disclaimer: This TradingView tutorial is for educational purposes only and should not be considered financial advice. Always do your own research (DYOR) before making any investment decisions.

5. [How to Use TradingView]: Level Up Your Trading Skills with Additional Resources

Learning to navigate the world of cryptocurrency trading takes time and dedication. Here are some TradingView resources to help you continue your education and refine your skills:

- TradingView Blog: A treasure trove of articles and educational content on various trading topics, including technical analysis strategies and platform tutorials: https://www.tradingview.com/blog/en/

- Online Courses: Numerous online platforms offer courses on cryptocurrency trading and technical analysis. Choose a reputable source that aligns with your learning style and experience level.

- Trading Books: Classic books like “Technical Analysis of the Financial Markets” by John Murphy can provide valuable insights into technical analysis concepts.

- Cryptocurrency News and Analysis Websites: Stay informed about the latest market trends and developments by following reputable cryptocurrency news and analysis websites.

If you want to further your education on How to Use TradingView, here are some additional TradingView tutorials:

- Complete TradingView Tutorial – 2023 Edition – YouTube

- I am new to TradingView. Where can I learn more on how to …

- FULL Tradingview Tutorial for BEGINNERS (2023) – YouTube

By combining the knowledge you’ve gained from this guide with ongoing education and practice, you’ll be well on your way to learning how to use TradingView for cryptocurrency trading. Remember, successful crypto trading requires discipline, patience, and a healthy dose of risk management. Good luck on your trading journey!